If you are looking to start a School in India, the first and foremost thing is to form a TRUST, SOCIETY or a SECTION 8 Company. The most important element which one should remember is the entity thus formed has to be Not-For-Profit and Non- Proprietary in nature.

Whether you opening a CBSE School, ICSE School, State Board School, IB School or school catering to any board, any school teaching Class I and above has to have TRUST, SOCIETY or a SECTION 8 Company managing the school.

So now there are couple of question which arises which we are seeking answers for;

Question 1: Is this the only way to start a school in India? If so, why?

Question 2: What is the difference between TRUST, SOCIETY or a SECTION 8 Company?

Question 3: Which one is better between TRUST, SOCIETY or a SECTION 8 Company?

Question 4: How do you form a Society, Trust, Section – 8 company?

Question 4: What is this “Non Proprietary” character ?

Question 1: Is this the only way to start a school in India? If so, why?

Answer: YES, this is the only way. You can either start a TRUST, SOCIETY or a SECTION 8 Company but mandatory requirement is it that they should be of Non for Profit and Non Proprietary Character. This is because government is very wary of some unethical private players posturing as educators and exploiting this basic need of every child. By laying this ground rule, Government tries to discourage these forces as much as possible. By making it Not for Profit, Government tries to rein in blatant commercialisation.

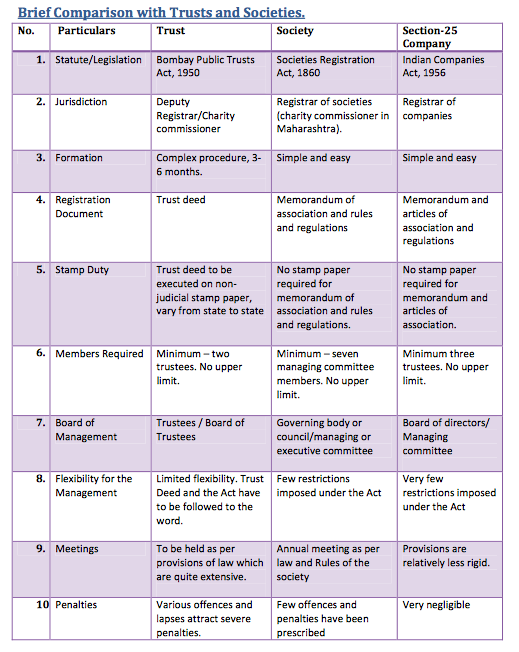

Question 2: What is the difference between TRUST, SOCIETY or a SECTION 8 Company?

The above table shows the differences between the three but the aims of establishing any of these stays the same.

Question 2: Which is better between the three – Society / Trust / Section 8 Company?

Of the three Section 8 is most preferred, here are the reasons

- It is easier to increase the number of directors, it is easier for people donating money to join or leave or transfer shares to others, and such a company is obliged to fulfil far less stringent book-keeping and auditing requirements as against a regular company. This is the biggest advantage in my opinion.

- The formation just requires two people hence a distinct advantage for promoters who are investing theirown money without any partners.

- Section 8 companies are much easier to run than Trusts and Societies, as board meetings require a smaller quorum and requirements for calling such meetings are less rigid.

- Section 8 is preferred by several businessmen because they are conversant with the company structure, while benefits from several exemptions make it easy for philanthropy.

- A Section 8 Company has more credibility as compared to any other Non-profit organization structure be it a Trust or Society. As it is a licensed by the central government. It has more stringent regulations such as no change in MOA and AOA can be done at any stage or situation in a Section 8 Company. A section 8 company due its strict compliances as regard to functioning has a more reliable image in comparison to other legal structures.

- Those looking to start with Partners – Section 8 is highly recommended, imagine a scenario , Partner is no more in this world, You want to infuse capital through getting moe partners, Partners want to exit the arrangement. It is never easy bit possibly it is easier with Company

Question 3 a: How do you form a Society ?

Societies are membership organizations that may be registered for charitable purposes. They are usually managed by a governing council or a managing committee and are regulated by the Societies Registration Act which has been modified and adopted by various states. Unlike trusts, societies may be dissolved. The main instrument of any society is the memorandum of association and rules and regulations (no stamp paper required), wherein the aims and objects and mode of management (of the society) should be enshrined.

Memorandum of association is the charter of a society. It is a document depicting and describing the objects of the its existence and its operations. However, article of association includes rules and regulations of the society under which it works.

A Society needs a minimum of seven managing committee members; there is no upper limit to the number of managing committee members. The Board of Management is in the form of a governing body or council or a managing or executive committee. The society has a Chairman, Treasurer, Secretary and ordinary members. There will be some permanent memebers and some temporary members.

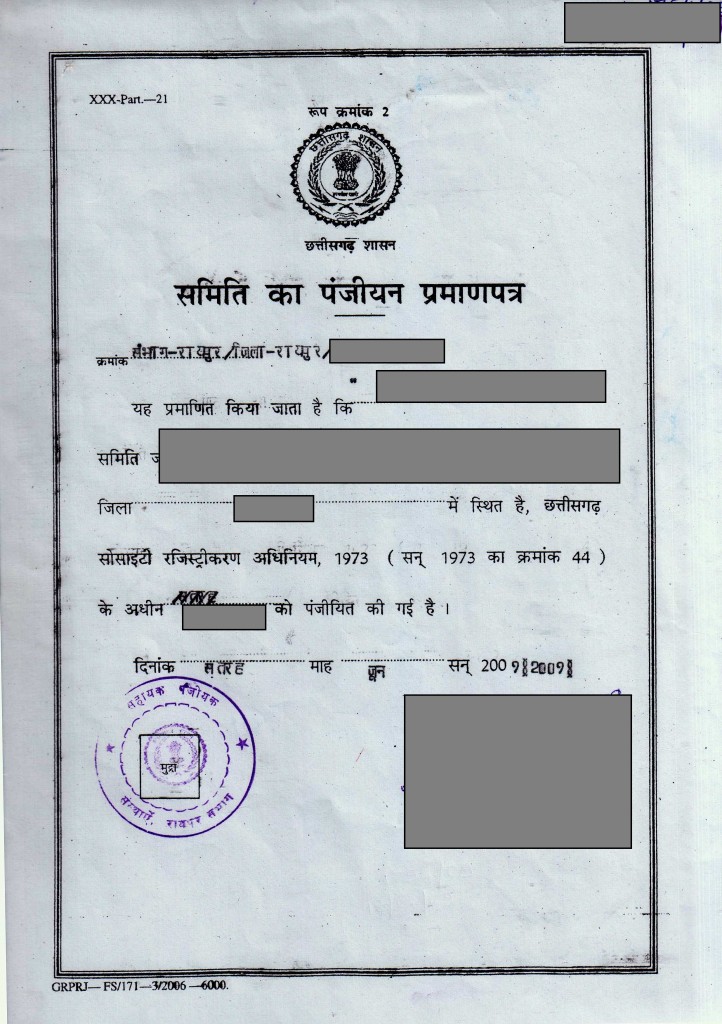

One applied for registration, the Registrar of Society will give the society a Registration Certificate.

Here this article on wikipedia is very helpful, I am copying some important lines from the wiki page

Question 3 b: How do you form a Trust ?

Public charitable trusts may be established for a number of purposes, including poverty relief, education, medical relief, the provision of facilities for recreation, and any other objective of general public utility. Indian public trusts are generally irrevocable. No national law governs public charitable trusts in India, although many states (particularly Maharashtra, Gujarat, Rajasthan, and Madhya Pradesh) have Public Trusts Acts.

- TRUST DEED: Trusts are registered using a document called TRUST DEED. This document contains all the information about the Trust and is printed/written/typed on plain A4 size papers.

- Attach a Rs. 100 Non-Judicial stamp paper (which you can get from a notary). All the Trustees and witnesses will have to give thumb impressions and signatures on these papers. All in all, you will need help of a notary to prepare the papers.

- You may also need a No-Objection Certificate (NOC) from the owner of the property where the registered office of the trust is to be situated. If you’re the owner of the property, then you don’t need to worry about NOC

- Following elements must be mentioned in the Trust Deed document:

- Name and address of the Settler (Settler is the person who is setting up trust)

- Name(s) and address(es) of the other trustees

- Name of the trust

- Minimum and maximum number of trustees your trust can have

- Address of the registered office of the trust

- Objectives of the trust

- Rules and Regulations of the trust

- For registering a trust you need minimum two trustees (i.e. one settler and another person). You can decide the maximum number of trustees and this number must be mentioned in the trust deed. All the trustees together are called Board of Trustees. This board collectively governs the trust.

- All the trusts are allowed to work on all India level

- Trusts are irrevocable –unless it is mentioned in the trust deed. This means that the trust cannot be wound up

- Trustees are usually life-long members or their tenure is specified in the deed. Electoral process is not involved in the appointment of trustees.

- Board of Trustees can also have various designations for trustees. Common designations are Chairperson and Managing Trustee.

Here this article on wikipedia is very helpful, I am copying some important lines from the wiki page

Question 3 C: How do you form a Section – 8 company ?

The formation of Section 8 Company happens through the portal of Ministry of Corporate Affairs. The steps are following

- A form called INC-1 is filed for the naming the proposed Section-8 company. The form in online and is called as Form meant to RESERVE THE COMPANY’s NAME. The promoters have to ensure that the proposed name selected does not contain any word as prohibited in Section 4(2) & (3) of the Companies Act, 2013 read with Rule 8 of the Companies (Incorporation) Rules, 2014. The name also should be unique. To search for the name, here is the service by the MCA

- Fill INC 12 – Click here for the form. This form is for the request of the Granting of the permission.

- Attach a draft copy of the Memorandum of Association (MOA) and Articles of Association (AOA). There is a prescribed format for Memorandum of Association of a Section 8 company in Form INC 13.

- Also one has to attach the following to the application – Estimated statement of Income & Expenditure for the next three years, List of Directors,

- There are other FORMS like INC – 7, INC – 8, INC – 9, INC – 12, INC – 13, INC – 14, INC – 15, INC – 16, INC – 22 and DIR – 2, DIR – 3, DIR – 12, which one has to fill giving detailed information about company’s particulars.

- One has to obtain Digital Signature Certificates (DSC) of the proposed directors.

Question 4: What is this “Non Proprietary” character ?

Answer: Not for Profit or Non Proprietary means the members of the managing committee of the society in No Way can withdraw PROFIT coming out of the business of the society or the trust for their personal gain. The Profit simply explained in business parlance will be BOTTOM LINE. Money should be channelized within the ambit of the not-for-profit areas of focus and its functional areas. Profit should be used only for the development and betterment of the objectives and aims of the entity.

| State | Address | Link |

|---|---|---|

| Uttar Pradesh | Registrar of Cooperative Societies , Govt. of Uttar Pradesh, 14 Vidhan Sabha Marg 3rd Floor, Vikasdeep, Lucknow, Uttar Pradesh 226001 | http://cooperative.up.nic.in |

| Chhattisgarh | Registrar of Cooperative Societies , Govt. of Chhattisgarh, Block - 3, 2nd and 3rd Floor, Indrawati Bhawan, New Raipur Tel : 0771 2511921 | http://rfas.cg.nic.in/Contact_us.aspx |

| Madhya Pradesh | Registrar Firms & Societies Department of Commerce & Industries Government of Madhya Pradesh D-Wing, First Floor, Vindhyachal Bhawan, Bhopal [M.P.] | http://registrarfirms.mp.gov.in |

| Punjab | Directorate of Industries, Ponch House, Lahore (Next to Chuburji) Phone : 0092-42-99211520-21 Fax : 0092-42-99211522 | http://dicludhiana.gov.in/frmSocietyRegistration.aspx |

| Bihar | Completely Online | 1) https://biharregd.gov.in/Society/Home.aspx 2) https://biharregd.gov.in/Society/Online/Society_Registration.pdf |

| Rajasthan | Registrar of Cooperative Societies , Govt. of Rajasthan, Nehru Sahakar Bhawan, Bhawani Singh Road, Jaipur 302 001 | 1) http://rajcooperatives.nic.in 2) http://forms.gov.in/RJ/5077.pdf |

| Jharkhand | Ground Floor, Engineer's Hostel - I, Near Golchakkar, Dhurwa, Ranchi, Jharkhand. | http://www.jharkhand.gov.in/office-of-registrar-cooperative |

| West Bengal | Department of Cooperation, Government of West Bengal New Secretariat Building(4th Floor), 1,K.S.Roy Road,Kolkata-700001 | http://coopwb.in/aboutus.html |

| Maharashtra | Commissioner for Cooperation Registrar of Cooperative Societies 2nd Floor, New Central Building, Ambedkar Wellesly Rd, Pune, Maharashtra 411001 Tel.: 020 2612 2846 | https://sahakarayukta.maharashtra.gov.in/Site/Home/Index.aspx |

| Tamil Nadu | No.100, Santhome High Road, Chennai 600 028. | http://www.tnreginet.net/english/society.asp |

| Kerala | Inspector General, Departmernt of Registration, Vanchiyur P.O Thiruvananthapuram. Kerala - 695035 regig.ker@nic.in contact 0471-2472118, 2472110 | http://keralaregistration.gov.in/?lang=eng |

| Andhra Pradesh | Office of the Commissioner & Inspector General of Registration and Stamps, 5-59, R.K.Spring Valley Apartments, Edupugallu, Kankipadu Mandal, A.P, Vijayawada - 521151 | http://www.registration.ap.gov.in |

| Telengana | D-Block, 4th Floor, Telangana Secretariat, Hyderabad-500022. Office : 040-29801057 | https://registration.telangana.gov.in/registrationsociety.jsp |

| Karnataka | Registrar of Cooperative Societies in Karnataka, Address: 1, Ali Asker Rd, Bengaluru, Karnataka 560052 | 1) http://sahakara.kar.gov.in/ContactUs.html 2) http://www.karnataka.gov.in/karigr1/Pages/Societies-Registration-Act-and-Rules.aspx |

| Himachal Pradesh | Block No.25, SDA Complex, Kasumpti, Shimla, Himachal Pradesh 171009 | https://coophp.nic.in/ |

| Uttarakhand | Registrar of Cooperative Societies, Govt. of Uttarakhand, Uttaranchal Secretariat, 4-B, Subhas Road, Dehradun 248001 Tel : 2713534 FAX: 2712268 | society.uk.gov.in/ |

| Haryana | Bays No. 27-30, Sector-2, Panchkula-134109. Phone No. : 0172-2585023, 2583438 | http://rcsharyana.gov.in/contact-us.htm |

| Gujarat | Registrar of Cooperative Societies , Govt. of Gujarat, Block No 10, 1st Floor, Old Sachivalaya Gandhinagar 382 010 Tel : 079-23253868, 079-23253862 , FAX: 079-23253877, 079-23253876 | https://rcs.gujarat.gov.in/introduction.htm |

| Manipur | Government of Manipur 4th floor, Western Block New Secretariat, Manipur-795001 | http://manipur.gov.in/?page_id=1697 |

| Assam | Registrar of Cooperative Societies , Govt. of Assam, Lakhtokia, Guwahati 781 001 Tel : 0361-2545334 , FAX: 0361-2545994 | http://assam.gov.in/web/registrar-of-firms-and-societies |

| Meghalaya | Registrar of Cooperative Societies New Administrative Building Lower Lachumiere, Shillong-793001 East Khasi Hills District, Meghalaya Phone Number : 0364 - 2225212 | http://megcooperation.gov.in |

| Tripura | O/O the R.C.S. Govt of Tripura. 1st Floor & 2nd Floor | http://tripura.nic.in/coop/ |

| Nagaland | Registrar of Co-operative Societies A.G. Office Road Kohima, Nagaland-797001 | http://nagalandcooperatives.com/page.aspx?page=legal_nsca |

| Sikkim | Government of Sikkim Annexe 1, Top Floor, Kazi Road Gangtok , Sikkim-737101 | https://www.sikkim.gov.in/portal/portal/StatePortal/Department/CooperationDept |

| Odisha | Near State Bank Of India, Kharvel Nagar, Bhubaneswar, Odisha 751001 | http://rcsorissa.nic.in |

| Goa | THE REGISTRAR THE OFFICE OF THE REGISTRAR OF CO-OPERATIVE SOCIETIES ‘SAHAKAR SANKUL’ 4 & 5 FLOOR, EDC COMPLEX, PATTO, PANAJI – GOA Tel:No: +91 - 832- 2437165/2437175/2437134 Email : reg-orcs.goa@nic.in | http://www.coopgoa.gov.in |

[Contact_Form_Builder id=”2″]

- Open / Starta School in India and CBSE Affiliation - May 31, 2022

- Private School getting Affiliated as a Sainik School - January 28, 2022

- Teacher Awards - September 20, 2021

I read some of your answers and formed a sec 8 company. Now my purpose is to start a primary school upto class 5th in a rented property for the poor kids. Motive is giving best of the education to the deprived ones.

Kindly guide me as to what is to be done next.

Hi,

Greeting of the Day! I hope you are doing Great. Me and My Friend is planning to start a school with affiliation to CBSE Board. I have few Queries on this.

1. More than 10 People are involved in this so Opening a trust or company or trust which one is the better option.

2. What are the approval Required to initiate School Project.

3. How much time generally it takes for all the approval.

4. Is there any regulation on fixing school fees.

Thanks

Govind Dahiya

Dear Govind,

Answering your questions

1. More than 10 People are involved in this so Opening a trust or company or trust which one is the better option.

A Section 8 company is the best option.

2. What are the approval Required to initiate School Project.

Kindly read my post by clicking here

3. How much time generally it takes for all the approval.

There are approvals required from different bodies like Town and Country Planning, PWD, Fire Department, Education Department, Secretariat etc. So to specifically state ‘how much time’ will be difficult.

4. Is there any regulation on fixing school fees.

Yes, there is almost in all the states.

I want to open school through SECTION 8 company. Can I take fees from students.

Yes, you can. That’s is what all the school do.

Will the siblings be considered in the same bloodline???

Yes, the siblings Father and Mother are the same Blood-line

Hi

Ur blog is quite enlightening…..I have few queries . I am an architect having designed schools also I m one of the trustee to a school though I am not active as trustee and just have invested so I want to know about my rights and responsibilities as trustee

Dear Advait, As a trustee, you are entitled to attend all the general meetings and essentially you should be privy to all the working of the trust. Read the bye laws of you trust to know more about your powers and responsibilities.

What action will be taken by CBSE BOARD

if the trust members are husbsnd and wife, the trustees are only 3 including a daughter who is a blood relative?

Isnt it a violation of byelaw???

Yes, it is

Hello sir I have land and wanted to start a school what should Be good form a trust or society, Is the name used for trust will be same for my school or it will be different

There is no rule which states that the name of the school should be same as that of trust/section-8 company/ Trust. So the names can be entirely different.

NEW.REGISTONSAN

Hi Abhiney,

1stly, thank you very much for taking the time to list this and for your insights, they gave me a certain amount of clarity. I have worked in a school run for underprivileged children for a few years. My family owns some land outskirts of the city where schools are not only rare but also ill equipped. I have a few investors willing to fund the infrastructure and help in the financial aspects of it. I want to run this school to provide free education to the local children there who cannot afford it otherwise. From the research I have done, it seems like setting up a trust is the right way to approach this, could you please advise if I am correct in my understanding?

Thanks!

Hello Shreya,

The best way to start in my understanding is Sections 8 Company, it is easier and just takes two people. Though a little expensive in terms of starting it, but less hassles in future. Read more online and consult an advocate.

Kindly suggest which is better to run a school through trust or society?

I am planning to open a school but unable to decide to register a trust or a society.

Dear Devendra, The best one I believe is Section 8 Company. I have written extensively about this on my blog, read the posts here

http://brightoninternational.in/teachclub/start-a-trust-society-section-8-company-for-school/

http://brightoninternational.in/teachclub/start-school-in-india-with-a-section-25-company/

Section 8 Company

My family owns a plot of land with a residential building in a town in Bihar. We have been approached by an individual for opening a school on the plot. We want to enter into a partnership with him for running the school.

Our experience in the field. The individual has experience of establishing a school of 500+ students on the outskirts of the same town. We ourselves have been running a school in our native village for the past eight years.

This is the first ocassion where we are thinking of entering a partnership model.

Please advise on what all should be consider before deciding on the avenue.

Dear Amit, I think we discussed this over the phone. Let me know if you need more sugestions on this.

A foreign investor is eager to invest in a school project in India. But since a school is run by a trust , how can we accomdate him & how will he be able to draw his share of profit ?

Kindly call me on my number +91 70002 40006